ASX is raising

Today’s market movement confirmed up move is coming to ASX. get ready for more bucks of your investment.

The Wyckoff trading method is an exceptional technical analysis approach to trading financial markets. The method’s founder, Richard Wyckoff, was an acclaimed trader and investor who lived in the early 20th century. As its foundation, the method focuses on studying price action, volume, and market structure to identify lucrative trends that present potential trading opportunities. Its historical successes have proven the Wyckoff trading method to be among the top technical analysis approaches that one can learn and apply in financial markets. So, if you are seeking an excellent trading technique, the Wyckoff trading method is an ideal choice for traders who want to achieve success in the financial markets.

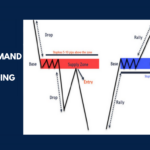

Supply and demand are two fundamental concepts in economics that also play a significant role in the forex market. In forex trading, the supply and demand levels refer to the areas on the price chart where there is a significant concentration of buyers (demand) or sellers (supply).

Institutional trading methods are often used in trading gold, as these methods rely on analyzing the behavior of large players in the market, such as banks, hedge funds, and other financial institutions. These players often have access to more information and resources than individual retail traders, making their trading decisions influential on the overall market.

At Wyckoff Trading Centre, we practice the Wyckoff method, supply and demand and The Matrix system. Our Analysis covered the market from Stocks, futures, Cryptocurrencies, Forex and Commodities. With our unique method, our trade setup is well aligned with institutional behaviour. Our Scanning tools scan the market by understanding Institutional behaviour. To learn more about our unique tools and methods, please contact us

Our Virtual trading floor operates around the clock and tap on each and every trading opportunity provided by our Inteli Trade Assistant. The well coordinated trading floor framework ensured we never break communications between our traders

Continuous education in the Wyckoff Trading Method and the development of the trading mindset is the key to the success of our trading system, which is the foundation of our Virtual Trading Floor

Today’s market movement confirmed up move is coming to ASX. get ready for more bucks of your investment.

Moving Average Cross Over (MACO) is a popular trading strategy that involves using two moving averages of different periods to identify changes in market momentum

Elliott Wave theory is a popular technical analysis approach used by traders to forecast market trends and identify potential trading opportunities. The theory is based

Institutional trading methods are often used in trading gold, as these methods rely on analyzing the behavior of large players in the market, such as

Supply and demand are two fundamental concepts in economics that also play a significant role in the forex market. In forex trading, the supply and

The Wyckoff trading method is a technical analysis approach to trading financial markets that was developed by Richard Wyckoff, a trader and investor who lived